- Abu Dhabi, United Arab Emirates.

- +971 2 698 4974

- snp@shipforsale.net

MARKET REPORT–WEEK27

BASED ON SALES AND PURCHASES OF VESSELS WEEKEND ED FRIDAY 7TH JULY2023.

WEEK 27 MARKET REPORT – SALES AND PURCHASES OF VESSELS

During the week ending on Friday, July 7th, 2023, the focus was on President Biden’s visit to Europe and whether any resolutions or clarity would be brought to ongoing NATO and Ukrainian war issues without any communication mishaps.

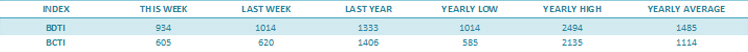

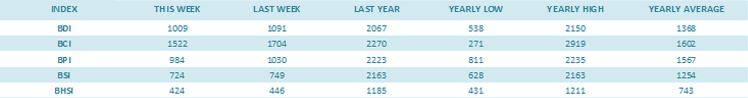

The dry cargo market’s BDI witnessed a further decline, closing at just 1,009 points. This resulted in a loss of -7.5% for the BDI last week, as all contributing dry indexes experienced a downturn. Specifically, the BCI dropped by 10.7%, the BPI by -4.5%, the BSI by -3.3%, and the BHSI by -4.9%. Currently, only capsize bulkers are fixing at over $10,000 daily, with an average of approximately $12,600. Kamsarmax, Supramax, and large handys are averaging daily t/c rates of about $8,800, $7,900, and $7,600, respectively. While these rates may not be encouraging many buyers of bulkers at first glance, our list of bulker sales in this report indicates that there are still numerous willing buyers if the price is right.

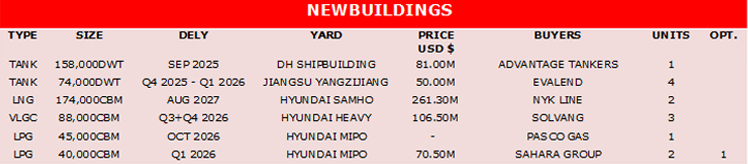

Tanker chartering rates, although reduced from March/April levels, remain profitable when compared to the previous years’ depression. Currently, VLCCs are earning high $30,000s per day, Suezmaxes in the low $30,000s daily, Aframaxes in the low/mid $30,000s, and MRs in the high teens per day. As a result, tanker values remain stable, but the number of sales being transacted has reduced as potential buyers closely monitor developments in the energy and finance sectors on a global scale.

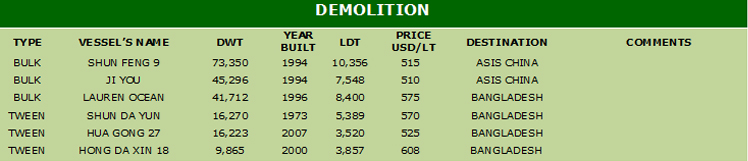

In contrast, the subcontinent recycling sector continues to remain quiet due to various factors. The scarcity of vessels being offered for demolition, Pakistan’s inability to participate due to the unavailability of LCs, Bangladesh’s Eid holidays, and the onset of monsoon rains in India all contribute to the subdued market conditions.